TAIPEI – Taiwan Semiconductor Manufacturing Co (TSMC) prioritizes auto chip production if it is able to further increase capacity, Taiwan’s Ministry of Economy told Reuters, amid a global shortage that has hampered auto production.

A ministry official said Minister Wang Mei-hua spoke with senior business leaders on the matter on Sunday.

TSMC had told the ministry it will “optimize” the chip manufacturing process to make it more efficient and prioritize automatic chip production if it can further increase capacity, the ministry said.

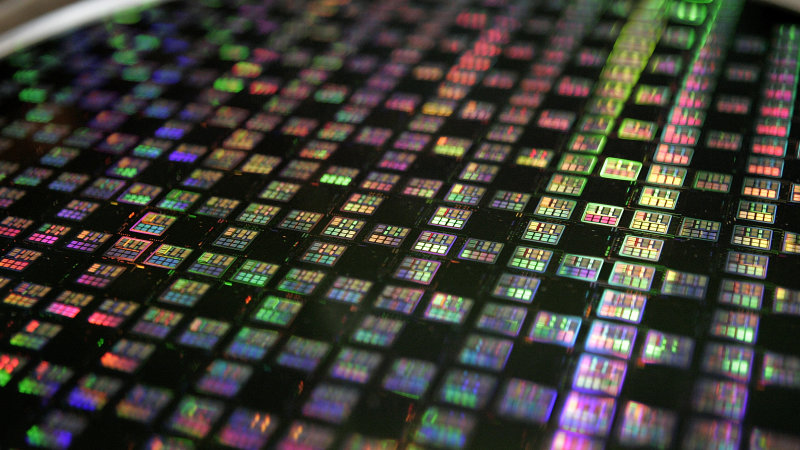

TSMC, the world’s largest contract chip manufacturer, stated that the current manufacturing capacity is full, but had assured the ministry that “if production can be increased by optimizing manufacturing capacity, it will work with the government to provide automotive chips as a primary application. consider “.

TSMC referred in a statement to Reuters to its Chief Executive Officer CC Wei’s comments on an earnings call this month.

“In addition to continuously maximizing the use of our existing capacity, Dr. Wei also confirmed at our investor conference that we are working closely with customers and moving some of their mature nodes to more advanced nodes, where we have a better capacity to support them, the company said.

Germany has asked Taiwan to convince Taiwanese manufacturers to help reduce the shortage of semiconductor chips in the automotive sector, hampering the fledgling economic recovery from the COVID-19 pandemic.

The request was made in a letter from the German Economy Minister Peter Altmaier to Wang.

The ministry said it would wait to receive the letter before deciding whether to contact TSMC again. Automakers around the world are closing assembly lines due to semiconductor supply issues, exacerbated in some cases by the actions of the former Trump administration against major Chinese chip factories.

Many car manufacturers affected

The shortage affects Volkswagen, Ford, Subaru, Toyota, Nissan, Stellantis and other car manufacturers.

The ministry told Reuters that it had received requests through “ diplomatic channels ” late last year from both the United States and the European Union, as well as from Germany and Japan this year.

It said auto companies cut orders to TSMC in the second quarter of last year, which in turn shifted capacity to other customers, but demand for auto chips returned in the second half of the year.

“The Americans announced the expectation late last year,” the ministry said.

“Right now, everyone is talking to each other through diplomatic channels, including TSMC. Everyone has their hands tied to orders, but from the government’s perspective, we will try to help as much as possible for our important allies.”

A spokesman for the European Commission said there had been “no specific talks” with Taiwan, but that they were closely monitoring the shortage of automatic chips.

A senior official in Japan’s Ministry of Economy, Trade and Industry told Reuters that the Japanese automakers association and TSMC were already in touch, and the ministry has also contacted the de facto Japanese embassy in Taipei to request their support in those talks.

The official added that it is mainly a private sector scholarship so the government is limited in what it can do.

In 2020, auto chips accounted for only 3% of TSMC’s sales, behind 48% for smartphones and 33% for high-performance chips.

In the fourth quarter, sales of TSMC’s auto chips were up 27% from the previous quarter, but still made up only 3% of total sales in the quarter.

A senior Taiwanese government official familiar with the matter told Reuters there wasn’t much they could do.

“They dropped their orders for a variety of reasons when demand was low during the pandemic. But now they want to boost production.”