Major automakers such as General Motors, Ford and Volvo have this week deepened ties with key technology partners to take on the challengers of electric cars Tesla Inc and Apple Inc as they gain steam to enter the market.

Three chip companies — Intel Corp’s Mobileye, Qualcomm and Nvidia — have emerged from a string of announcements at the Consumer Electronics Show in Las Vegas as the leaders in shutting down the brains of self-driving cars for the next decade.

The deals include consolidating dozens of older, slower chips into more powerful centralized computers. But to win them, the chip makers had to agree to let automakers get their hands on key parts of the technology.

Reuters previously reported that Apple is planning an electric car. Bloomberg reported last year that the iPhone maker is aiming for full self-driving capabilities as early as 2025.

For automakers who stand against Apple and Tesla, the stakes are high. In addition to electrifying their models, automakers are essentially designing computers with increasing self-driving capabilities.

That represents a great opportunity for automakers to monetize in-car software and services long after vehicles roll off a dealer’s lot, but only if they can keep customer relationships and data to themselves, like Tesla and Apple do.

Automakers “that haven’t been the pioneers are finally realizing that they will be left in the dust if they don’t change their approach,” said Danny Shapiro, vice president of automotive at Nvidia, a maker of high-performance chips. .

Nvidia this week announced deals to provide the electronic brain for future models from several Chinese electric vehicle startups, and is partnering with other automakers including Mercedes, Hyundai Motor Co, Volvo and Audi.

Control over technology and data are tensions between automakers and tech companies, Shapiro said. “Control and customization, and who owns the data?”

The answer is complex because of the staggering amount of technology needed to make cars drive themselves.

These include computer vision algorithms to help cameras spot pedestrians, expansive high-definition maps of the world’s roads, and “driving policy” software to make millisecond decisions about how the car should behave when faced with the unexpected.

For chipmakers, this means having every aspect of the technology ready, but willing to let customers choose.

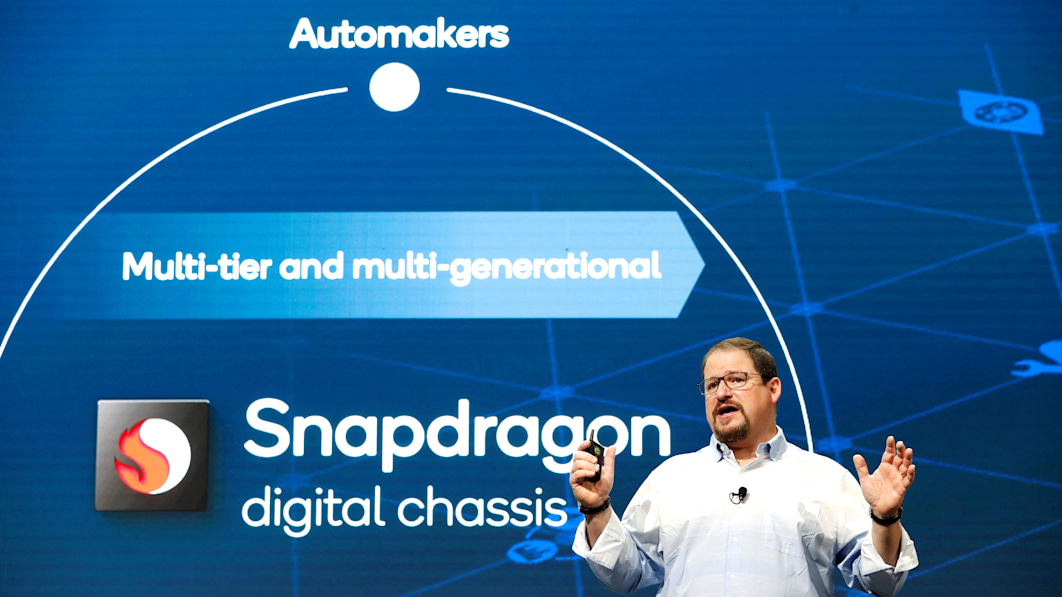

Qualcomm Inc, for example, spent $4.5 billion last year to buy Veoneer Inc to supplement all the pieces of software needed to complement its self-driving car chips. But after winning its first major self-driving chip contract with GM this week, those software assets won’t be included because GM has one of its own.

“Our software stack is all developed in-house. So we don’t take their piece,” said Jason Ditman, chief engineer for GM’s upcoming “Ultra Cruise” hands-free driving product.

But for other automakers, Qualcomm needs to have all the parts of a self-driving system ready, said Nakul Duggal, senior vice president and general manager of automotive at the chip company.

“Different automakers are at different points of readiness,” he said. “What’s critical for the automaker is that they need to be able to build a relationship with the customer they’re trying to acquire.”

A similar dynamic is at play in Mobileye’s relationship with Ford, which was deepened this week. Mobileye used to deliver its camera, chip and self-driving software as an all-in-one product. Now Mobileye will begin to separate some of its system functions and allow Ford to build its own technology on top of it.

“We’ll supply all of the output to Ford, and they will use their own algorithms on top of our output,” Amnon Shashua, Mobileye’s chief executive, told Reuters.

The chip companies have little choice but to be more flexible, as they have to deal with important competitors of their own.

Automakers had relied on three main suppliers for the simpler semiconductors that power combustion engines — Infineon, Renesas and NXP, said Phil Amsrud, a senior principal analyst at IHS Markit.

But the market of chip companies supplying high-performance computers to car manufacturers is relatively crowded, including Chinese companies such as Huawei Technologies Co Ltd and computer vision company Ambarella Inc entering the automotive sector.

“We are at a point where we may be getting too many suppliers,” said Amsrud. “If you look at cars traditionally, there have never been more than a handful.”

(Reporting by Stephen Nellis in San Francisco and Joseph White in Detroit; editing by Richard Chang)