OAKLAND, Calif. – Long-targeting software and Internet companies, Silicon Valley venture capitalists are once again pouring money into the semiconductor industry, lured by the promise of a new generation of artificial intelligence chips that could challenge established companies like Intel and Nvidia.

The new wave of semiconductor innovation will do little to address the shortage of chips based on older technology that is currently plaguing the automotive industry and others. The shortage stems from a confluence of factors as automakers, who shut down factories during last year’s COVID-19 pandemic, battle the expanding consumer electronics industry for chip supplies.

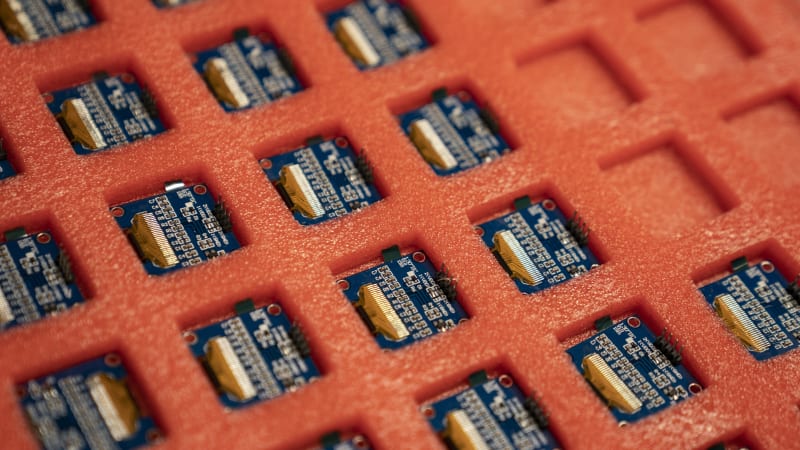

The enthusiasm for chip start-ups is mainly a result of the need of companies using AI software for special-purpose processors that can efficiently run machine learning algorithms that require massive amounts of data – the heart of the thriving artificial intelligence business.

Start-up chip makers, including SambaNova Systems, Groq and Cerebras Systems, all say they make chips that can perform AI tasks better than processors from Nvidia, whose multi-functional graphics chipsets – originally made for video games – now dominate the AI market.

“How can a car be good at driving fun and good at taking the kids and soccer balls to soccer practice and transporting cargo, rocks and garbage? The answer is that it can’t, ”said Andrew Feldman, co-founder and CEO of Cerebras Systems, arguing that AI algorithms require specific chips rather than chips that can serve multiple purposes.

Cerebras’ innovation is a very large chip, 56 times the size of a postage stamp, containing 2.6 trillion transistors.

Gartner analyst Alan Priestley has counted more than 50 companies that are now developing chips specifically for AI applications and said there may be more. He expects the market to be worth more than $ 70 billion by 2025, up from $ 23 billion in 2020.

Venture funding for US chip startups reached $ 1.8 billion last year, the highest level in at least two decades, according to data company PitchBook. This year, $ 1.4 billion has already been invested.

In April alone, SambaNova said it raised $ 676 million for its reconfigurable AI chips. Groq, which boasts a super-powerful single-core design that is fast and easy to program, announced it had raised $ 300 million. The CEOs of both companies told Reuters the funding rounds were larger than planned due to strong investor interest.

All of these activities come as the U.S. government finalizes new grant programs to support the domestic chip industry. Andy Rappaport, a new Groq board member who has invested in chips for decades, believes that the geopolitical instability and competition between the United States and China may even prompt venture capital firms to invest not only in chip design companies, but even manufacturing. “If the federal government wants to guarantee my returns and underwrite my risk, you could see a credible scenario where a new manufacturing player could emerge,” he said.

That, in turn, could trigger even more bets on chip design companies. “Knowing manufacturing was no longer a problem makes it easier for me to invest in the IC companies,” said ACME Capital venture capitalist Hany Nada, referring to integrated circuit or chip suppliers.

Ironically, with AI chips, it becomes easier for AI algorithms to improve chip production, cut costs and reopen production to startups, said Matthew Putman, who started Nanotronics in 2011 to do just that, and a Peter’s early investment. Thiel’s Founders Fund.

In 2019, Nanotronics had raised approximately $ 90 million. And Putnam is no longer worried about where the funding will come from.

“In 2013 or 2014, when I went in and literally if you didn’t have an app or any kind of business SaaS software you wouldn’t even get past the receptionist,” he said, adding that this was even after Founders Fund had invested. “That has changed a lot.”

Meanwhile, the U.S. Department of Commerce is urging Taiwan Semiconductor Manufacturing Co Ltd and other Taiwanese companies to prioritize the needs of U.S. automakers to reduce chip shortages in the short term, Commerce Secretary Gina Raimondo said.

Raimondo told a Council of the Americas event on Tuesday that more investment was needed in the longer term to produce more semiconductors in the United States and that other critical supply chains needed to be backed up, including to allied countries.

“We’re working hard to see if we can get the Taiwanese and TSMC, which is a big company there, to, you know, prioritize the needs of our auto companies, given that so many American jobs are at stake, Raimondo said in response to a question from a General Motors Co. president.

“Like I said, not a day goes by that we don’t insist,” she said. The medium- and long-term solution would be “just make more chips in America”.

On Wednesday, TSMC said addressing the deficit remains its top priority.

“TSMC has worked with all parties to reduce the shortage of automotive chip supplies. We understand it is a shared concern of the global automotive industry,” he said in a statement to Reuters.

Last month, Chief Executive CC Wei said TSMC had been working with customers since January to redeploy more capacity to support the auto industry, but the shortage was made worse by a snowstorm in Texas and a fab production outage in Japan.

Wei expected the shortage of chips for the company’s automotive customers to decrease sharply from the next quarter.

Taiwanese Economy Minister Wang Mei-hua told lawmakers in Taipei that many countries had sought help from the government and TSMC.

However, TSMC has a commercial mechanism and must adhere to commercial standards, she said on Wednesday without elaborating.

The Department of Commerce is planning a meeting with auto makers next week about the chip shortage problem, officials said on the matter. A spokesman for the Department of Commerce declined to comment.

Josh Nassar, United Auto Workers’ legislative director, said in a written statement before a US House hearing on Wednesday that the chip shortage had led to the layoffs of “tens of thousands of workers.”

He added, “Clearly, we need to strengthen domestic automotive grade semiconductor manufacturing.”

Last week, Ford warned that the shortage of chips could halve production in the second quarter, costing it about $ 2.5 billion and losing about 1.1 million units of production by 2021.

On Friday, GM said it would extend production shutdowns at several North American plants due to the shortage.

On April 12, President Joe Biden convened semiconductor and automotive executives to discuss solutions to the crisis. He is supporting $ 50 billion to support US chip production and research.

(Reporting by David Lawder and David Shepardson in Washington, Jane Lanhee Lee in Oakland, California; Additional reporting by Ben Blanchard, Yimou Lee, and Jeanny Kao in Taipei; edited by Stephen Coates, Clarence Fernandez, Jonathan Weber, and Matthew Lewis)