The computer chip shortages that forced global automakers to scrap production plans for millions of cars over the past two years are easing — with new and permanent costs for the auto companies.

What were “warspace operations” to manage chip shortages are becoming embedded features of vehicle development, executives in both sectors say. That has shifted the risks and some of the costs to automakers.

Newly created teams such as General Motors Co, Volkswagen AG and Ford Motor Co negotiate directly with chipmakers. Automakers such as Nissan Motor Co Ltd and others are accepting longer order commitments and higher inventories. Major suppliers, including Robert Bosch and Denso, are investing in the production of chips. GM and Stellantis have said they will work with chip designers to design components.

Taken together, the changes represent a fundamental shift for the auto industry: higher costs, more hands-on work in chip development and more capital in exchange for better visibility of their chip inventories, executives and analysts say.

It’s a sea change for automakers that previously relied on suppliers — or their suppliers — to source semiconductors.

For chipmakers, the ever-evolving partnership with automakers is a welcome — and overdue — reset. Many semiconductor executives are pointing the finger at automakers’ lack of understanding of how the chip supply chain works — and an unwillingness to share costs and risks — for much of the recent crisis.

The costly changes come together as the auto industry appears to be past the worst of an even more costly crisis, which, according to one estimate, has taken 13 million vehicles out of global production since early 2021.

They never called

CC Wei, chief executive of the world’s largest chipmaker Taiwan Semiconductor Manufacturing Co, said he had never called an auto industry director — until the shortage was acute.

“For the past two years, they’ve been calling me and acting like my best friend,” he recently told a laughing crowd of TSMC partners and customers in Silicon Valley. An automaker called to urgently request 25 wafers, said Wei, who is used to handling orders for 25,000 wafers. “No wonder you can’t get the support.”

Thomas Caulfield, CEO of GlobalFoundries Inc, said the auto industry understands it can no longer leave the risk of building multibillion-dollar chip factories to chipmakers.

“You can’t let one element of the industry carry the water for the rest of the industry,” he told Reuters. “We will not deploy capacity unless that customer is committed to it and has a state of ownership in that capacity.”

Ford has announced that it will partner with GlobalFoundries to secure the supply of chips. Mike Hogan, who heads GlobalFoundries’ auto division, said more such deals are in the pipeline with other automakers.

SkyWater Technology Inc, a chip maker in Minnesota, is talking to automakers about “skin in the game” by buying equipment or paying for research and development, Chief Executive Thomas Sonderman told Reuters.

Closer collaboration with automakers and their suppliers has brought about $4 billion in long-term deals for power management chips made from silicon carbide, a new material that is gaining popularity, said Chief Executive Hassane El-Khoury. “We’re investing billions of dollars every year to scale that operation,” he told Reuters. “We’re not going to build factories on hope.”

Michael Hurlston, the CEO of Synaptics Inc, whose chips power touchscreens that had held up some auto production, said the recent, more direct partnership with automakers could create new business opportunities and manage risk.

Hurlston said the auto industry has warmed to the use of OLED screens, which are less durable than LCD screens, a factor many believe would limit their use in cars, despite better contrast and lower power consumption.

“But that perception has changed quite drastically in the past two years. And that perception has changed as a direct result of being able to talk to[the auto industry],” he said. “The paradigm has really, really changed for us.”

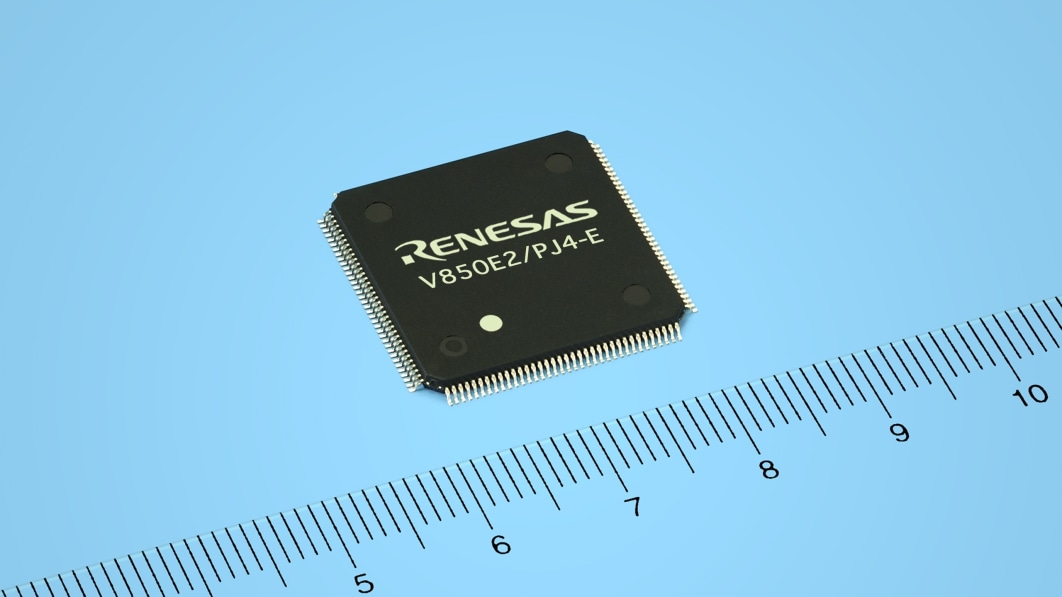

Chief executives of Japan’s Renesas Electronics Corp. and Netherlands’ NXP Semiconductors NV have both told Reuters they are recruiting engineers to help automakers design a new architecture where one computer controls all functions centrally.

“They have woken up,” says NXP CEO Kurt Sievers. “They have understood what it takes. They try to find the right talent. It’s a big shift.”

‘We got it’

According to Gartner, the average semiconductor content per vehicle will exceed $1,000 by 2026, doubling from the first year of the pandemic. An example: the battery-powered Porsche Taycan has more than 8,000 chips. According to Volkswagen, that will double or triple by the end of the decade.

“We understand that we are part of the semiconductor industry,” said Berthold Hellenthal, senior manager of the Volkswagen Group, for semiconductor management. “We now have people who are only concerned with strategic semiconductor management.”

Securing — and retaining — chip engineers will be a challenge for automakers, who will have to compete with Google, Amazon.com Inc and Alphabet Inc’s Apple Inc, said Evangelos Simoudis, a Silicon Valley venture capital investor and advisor who partners with both established automakers. as startups. “I think that would lead to acquisitions,” he said.

Unlike Tesla Inc, which designs its own core chips, Simoudis said traditional automakers will have to juggle the production of older car models as they make new investments.

AutoForecast Solutions (AFS) estimates that microchip shortages have forced automakers around the world to cut more than 13 million vehicles from production plans since early 2021.

“It’s an arrogant industry,” said Sam Fiorani, vice president of global vehicle forecasting at AFS. “Sometimes it just bites them in the back.”