TAIPEI / SEOUL – Asian chip makers are rushing to expand their manufacturing capacity to accommodate a global shortage that has been acutely felt by automakers, but the companies warn that it could take many months to fill the supply shortfall as they struggle to keep up with strong demand.

Automakers from General Motors to Stellantis and Honda Motor are closing assembly lines over the shortages, exacerbated in some cases by the former US government’s sanctions against Chinese chip factories. Some firms have also taken time off work.

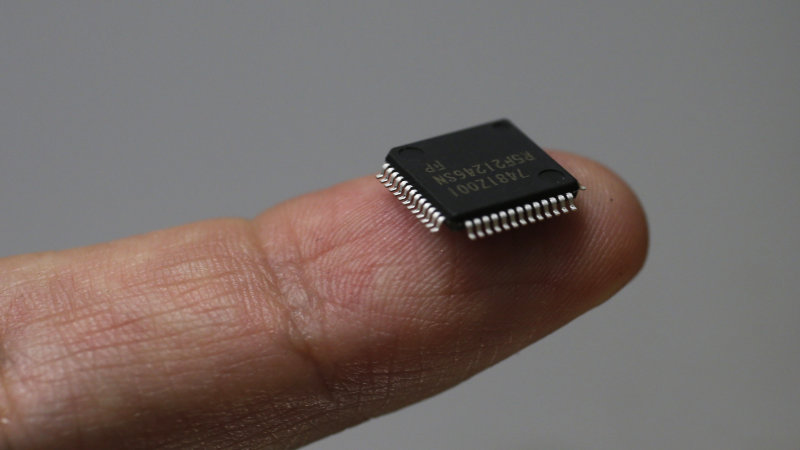

8-inch chip factories mainly owned by Asian companies, which tend to make older, less advanced chips, are especially under pressure due to under-investment in recent years. Most such factories are used to make car chips.

Consumer demand in China, especially for cars, has fallen unexpectedly rapidly following the coronavirus crisis, and orders for products such as laptops and cell phones in regions still experiencing pandemic restrictions, such as Europe and the United States, have also increased.

Global chip shortage concerns were highlighted by recent quarterly business figures from Taiwan Semiconductor Manufacturing Co Ltd (TSMC) to South Korean SK Hynix.

“We are now under a lot of pressure,” said Zhao Haijun, co-CEO of China’s top chip maker Semiconductor Manufacturing International Corp., who last week announced plans to expand capacity by 45,000 wafers per month in its 8-inch this year. factory.

However, the company warned that the capacity increase would not happen soon due to longer turnaround times for equipment procurement, as it grapples with supply chain disruptions due to sanctions imposed by the former Trump administration.

“We basically have at least one video conference per day with a customer on how to increase capacity and what adjustments we can make to products,” said Zhao.

TSMC, the world’s top contract chipmaker, said it ‘accelerated’ automotive related products through its wafer mills and reallocates wafer capacity and now expects to increase capital expenditure on advanced chip manufacturing and development to between $ 25-28 billion this year , a whopping 60% higher than the amount it spent in 2020.

United Microelectronics Corp (UMC), another Taiwanese chip maker, plans to spend $ 1.5 billion on new equipment this year, up 50 percent from $ 1 billion last year.

South Korean SK Hynix, the world’s No. 2 memory chip manufacturer, said it was accelerating plans to move its 8-inch facilities to China, which is expected to cut costs in the face of the 8-inch boom. The company wants the move to happen “as soon as possible” rather than over an initially planned period of two years.

Renesas Electronics Corp said Monday it is in talks to buy Anglo-German chip designer Dialog Semiconductor for about $ 6 billion in cash as the Japanese chipmaker wants to capitalize on growing demand for automotive chips. Renesas will publish its latest result on Wednesday.

The combination of a shortage of supply and rising demand has put prices under pressure. UMC expects overall chip prices to rise 4-6% this year due to supply restrictions that will take a few more quarters, while Renasas told Reuters they were negotiating a 15% increase on auto chips and between 10% and 20% for others potato chips.

Japanese companies with automotive semiconductor business have so far provided little detail on any shortages or the impact on customers.

“We are working hard with semiconductor manufacturers, and the inventory crisis should ease as capacity growth catches up this summer,” said Yasushi Matsui, chief financial officer at major Toyota Motor Corp. parts supplier Denso Corp, last week.

Fang Leuh, the chairman of Vanguard International Semiconductor Corp, whose largest shareholder is TSMC, said the demand frenzy “wouldn’t last forever.”

“Sooner or later it will overheat, some of them will come down or fall back.”

(Additional reporting by Josh Horwitz in Shanghai, Tim Kelly in Tokyo; Writing by Brenda Goh; edited by Shri Navaratnam)