Four raw materials represent the bulk of the raw material costs of a vehicle: steel, aluminum, plastic resin and copper. Photo credit: BLOOMBERG

The raw material prices fluctuate around six years when automakers struggle with volatile costs of steel, aluminum, copper and plastics.

In August, raw material costs for vehicles built in North America amounted to an average of $ 2,000 per unit – about $ 221 more than a year earlier – according to New York consultancy firm AlixPartners.

Four raw materials represent the bulk of the raw material costs of a vehicle: steel, aluminum, plastic resin and copper. The price of copper and some other materials "are starting to fall from their peak in May and June," said Dan Hearsch, a managing director of AlixPartners.

But there is a catch. American manufacturers have to pay a rate of 10 percent on imported aluminum, so the price of that metal can turn out to be volatile. And the AlixPartners index – which derives aluminum prices from the London Metal Exchange – does not yet reflect the rate.

In June, the White House submitted Canada and Mexico to American aluminum and steel tariffs. Automakers begin to feel the impact.

In September, Ford CEO Jim Hackett acknowledged that his company charges $ 1 billion in profits. And in July, General Motors said raw material costs were $ 300 million higher in the second quarter than a year earlier.

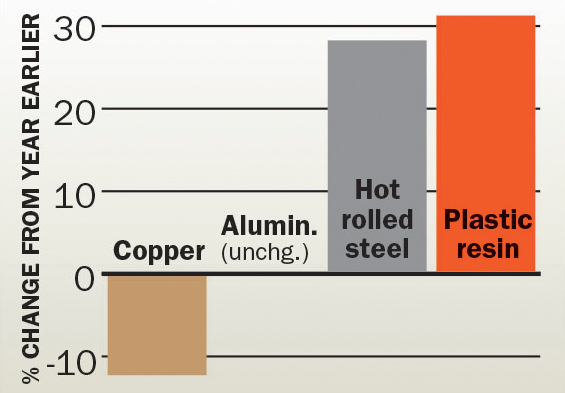

Hot-rolled steel prices have increased by 28 percent to 40 cents per pound last year, according to AlixPartners. Automakers buy most of their steel in North America, but certain types – such as stainless steel and electric steel – are imported under the 25 percent US rate.

In the meantime, the prices of synthetic resin rose by 31 percent because the raw material costs had increased in the past year.

In order to control raw material prices, car manufacturers usually buy bulk for resale to suppliers. Toyota Motor Corp is doing this for steel, aluminum and plastic resin, says Bob Young, the North American head of the automaker.

Toyota also allows component prices of suppliers to float as raw material costs fluctuate.

The most important costs are rising

Raw materials in a typical North American built vehicle cost $ 2,000 in August, an increase of about $ 221 from a year earlier. Steel, aluminum, plastic resin and copper are the largest part of the raw material costs. Note: steel and plastic prices are based on US indices. Aluminum and copper prices are derived from the London Metal Exchange. Source: AlixPartners

Note: steel and plastic prices are based on US indices. Aluminum and copper prices are derived from the London Metal Exchange. Source: AlixPartners

"We believe that our suppliers have no control over raw material prices," says Young. "We do not want our suppliers to use resources to manage that, we want them to focus on the costs they can manage."

Suppliers are expected to reduce scrapping and weight.

"If the supplier has 50% scrappage, they are not costs that we will absorb," Young said. "If they are not efficient, they will absorb the costs."

The merchandise is steel, says Young. In North America, the purchase of steel by Toyota totals $ 1.8 billion per year. Toyota negotiates one-year steel contracts that can be renewed in April, leaving the company somewhat isolated from recent price increases. But only slightly.

Young says steel prices in North America are significantly higher than in other regions.

"If you look at different types of steel – hot-rolled, cold-rolled, coated – that's about 40 percent," Young said. "This is hard to justify from a cost perspective, and if we want to remain competitive globally, we need to see a price improvement."

So what is the future of raw materials? Hearsch is reluctant to make predictions. In the first eight months of 2018, North American light vehicle production was 11.4 million units, down from 11.8 million a year earlier.

Theoretically, the prices of raw materials should decrease as the demand collapses. But it is unclear whether vehicle production accurately predicts a broader economic downturn, Hearsch said.

"The car industry is just one of the major users of these raw materials," he said. "Production slows, but we do not predict if this is a big drop."